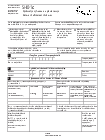

Return of Allotment of Shares

PDF 674 KB 10 pages. Applicants for 21500 in respect of applications for 2000 or more received 10200 shares.

Return Of Allotment Of Shares Sh01c Gov Uk

Allotment Dates From Date d d m m y y y y Allotment date If all shares were allotted on the same day enter that date in the from date box.

. If company fails to file PAS-3 within 30 days from date of allotment then the company and the officer in default will be liable to penalty of INR 1000 for each day during which defaults continues or INR 100000 whichever is less. Viviana Power Tech Limited is catering to the clients requirement in the field of Power Transmission. Outcome of the 31 st Annual General Meeting of the Company.

Viviana Power Tech IPO date is fixed The IPO will open on September 5 and will close on September 8 2022. Shares allotted Please give details of the shares allotted. Allotment of Shares - Sep 16 2022.

SH01 return of allotment of shares. Best Shares Under Rs 50 Highest Return On Asset. A company made an issue of 30000 shares of Rs.

Within a month of the date of the share allotment form SH01 must be delivered to Companies House. The Viviana Power Tech IPO price band is fixed at 55 with a market lot of 2000 shares. Holding shares in physical form.

Annual Return Corporate Policies Secretarial Compliance Report. Return of allotment of shares What this form is for You may use this form to give notice of shares allotted following incorporation. Return on asset is an indicator that shows how profitable a company is relative to its Assets.

If shares were allotted over a period of time complete To Date d d m m y y y y both from date and to date boxes. 10 each payable Rs. The SH01 form does not require details of the shareholders to whom shares have been issued just the shares.

Provided further that the provisions of this sub-rule shall not apply in case of issue of shares for consideration other than cash. Viviana Power Tech is an NSE SME IPO to raise 880 crores via IPO. 6 A return of allotment of securities under section 42 shall be filed with the Registrar within fifteen days of allotment in Form PAS-3 and with the fee as provided in the Companies.

Harsha Engineers International whose initial public offering IPO received an astounding response during the three-day bidding process is likely to finalise its allotment status on Wednesday September 21. SECTION 62 of Companies Act 2013. The Provisions of Section 62 of the Companies Act 2013 bind all Private companies public companies listed and unlisted.

The Rs 755-crore IPO consists of issuance of fresh equity shares worth Rs 455 crore whereas existing shareholders and promoters will offload Rs 300 crore. 5 on allotment and Rs. It gives you an insight into how efficient the company is at using its assets to generate revenue.

Heres how you can check your IPO allotment status. One of the largest manufacturers of precision bearing cages in organised sector in India Harsha Engineers International Limited had fixed the IPO size at Rs 755 crore which comprised a fresh issue of Rs 455 crore and open offer for sale OFS of Rs 300 crore. This describes the overall structure of a companys shares and how much if anything is left unpaid on them.

STBX stock quote history news and other vital information to help you with your stock trading and investing. NDTV on Thursday argued that its promoters cannot yet transfer shares in the television channels parent entity to Adani Group firms citing a November 2020 ruling by the markets regulator which. This form includes a statement of capital.

If the number of Existing Ordinary Shares in issue at the Record Time is greater than expected such that returning 10169 pence per Existing Ordinary Share would result in a return of capital which exceeds 375 billion then the return per Existing Ordinary Share may at the discretion of the Board be reduced by such amount as is required to prevent the aggregate return of capital. Allotment of shares through private placement. Allotment of shares to Public at large.

Find the latest Starbox Group Holdings Ltd. Prohibition on further issue of shares- The company shall not make a further issue of the same kind of shares including allotment of new shares under clause a of sub-section 1 of section 62 within a period of six months except by way of a bonus issue or in the discharge of subsisting obligations such as conversion of warrants stock option schemes sweat equity or. What this form is NOT for You cannot use this form to give notice of shares taken by subscribers on formation of the company or for an allotment of a new class of shares by an unlimited company.

Meaning of Right Issue of Shares. Check out the list of Shares Under 50 Rs that offer the highest Return on Asset. Harsha Engineers IPO Allotment Date.

This form can be used to give notice of shares allotted following incorporation. A total of 93200 shares were applied for and owing to this heavy oversubscription allotments were made as follows. Right Issue refers to the act of offering shares to the existing members of the company in proportion to their current shareholding via a letter of offer.

Form 24 Return Of Allotment Of Shares Pdf

Pas 3 Form Return Of Allotment Learn By Quickolearn By Quicko

It Service Contract Template Unique Template Contracts For Services Template Contract Template Computer Repair Services Work For Hire

Form 24 Return Of Allotment Of Shares Pdf

0 Response to "Return of Allotment of Shares"

Post a Comment